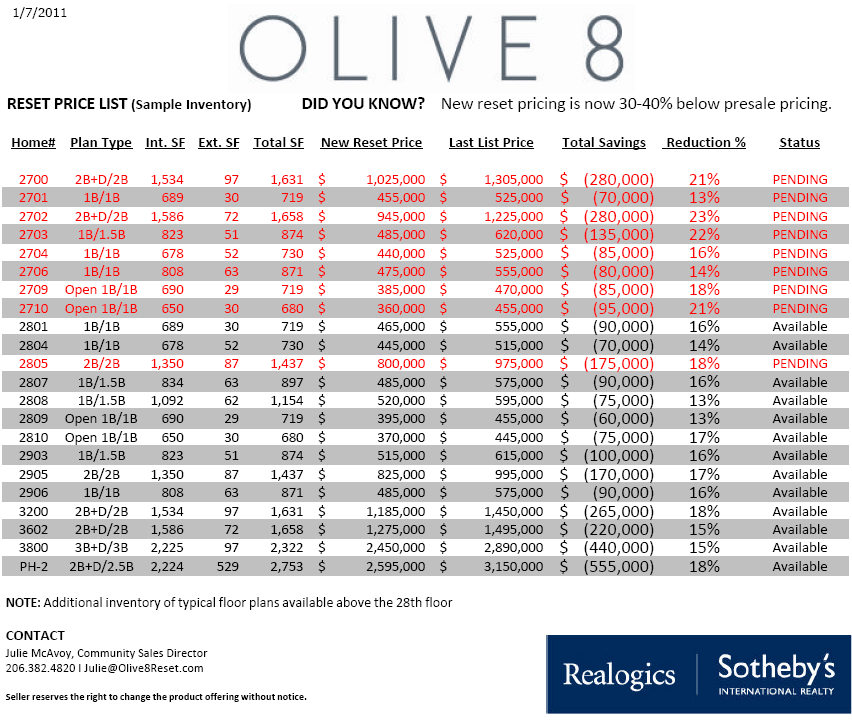

Olive 8 Pricing – Reduced By An Average Of 18%

This weekend Olive 8 announced their revised pricing now that they’ve “reset”.

Dropping into Excel we calculated the dollars per square foot:

Open 1 Bd – $558/sf to $572/sf

1 Bd/1.5 Ba – $476/sf to $625/sf

1 Bd/1 Ba – $588/sf to $675

2 Bds – $593/sf to $1167

A quick glance at the Olive 8 auction results give me the impression that those who bought at auction got a better deal than these reset prices.

From their press release it sounds like they’re not going to budge much on pricing now that they’ve reset:

David Thyer, President of RC Hedreen Company and developer of Olive 8 says he monitors market values but acknowledges the only price that matters is the one that a buyer wants to pay. “We’re not inclined to further discount given recent sales comps in the building,” he said. “We know Olive 8 provides a great value today and we’re working our way up the building. Our three year construction loan extension provides us the time to sell into an improving marketplace over the next two years or so. Fortunately, we’ve saved our best inventory.”

McAvoy reports 10 new sales have been accepted so far in 2011 and active negotiations are taking place on several other homes. “I think buyers and sellers are finding better balance in supply and demand at Olive 8 and elsewhere,” she said. “It’s a signal that the market is stabilizing and an increase in sales means buyers are becoming more confident in home values.”

Links:

Disclaimer: Realogics & Olive 8 are Urban Living advertisers.

OLIVE 8 CONDOS REINTRODUCED TO MARKET WITH ASKING PRICES REDUCED AN AVERAGE OF 18%

Developer “Reset” Approach Implemented to Help Spur Sales in a Dynamic Market

(SEATTLE, WA.) January 7, 2011 – Executives of Realogics Sotheby’s International Realty today released a sample price list for remaining inventory above the 27th floor at Olive 8 – a 229-unit condominium and hotel development in downtown Seattle. The new pricing strategy includes reductions across the board that vary from about 15% to more than 25% on some homes, according to Julie McAvoy, the Community Sales Director for Olive 8.

“Effectively, the price reductions is our seller making the first offer to homebuyers in this dynamic marketplace,” said McAvoy. “Selling today requires a conversation and we’re listening.”

The new price list comes out about a year after prior reductions that ranged from 10-15% and last fall an auction helped sellout targeted inventory below the 27th floor, according to McAvoy and NWMLS history. She estimates the total reductions in aggregate now range from 30-40% below presale pricing in 2007. “It a compelling opportunity for savvy homebuyers,” said McAvoy. “With prices correcting, timing the market may now have more to do withs ecuring preferred selection and historically low interest rates versus anticipating further price cuts. I think we’re at a pivotal time in the center-city (Seattle) housing market and each community has a unique relationship within it.”

A preliminary look at median home prices (year-over-year) for all condominiums (new and resale) in downtown Seattle suggest a 13% correction from a peak in 2007 compared with 2010, according to NWMLS records. Meanwhile inventory appears to be shrinking, most notably due to a lack of new construction since the credit crunch stopped additional development in 2007. Pundits agree no new condo towers are expected to arrive to market for at least several years.

David Thyer, President of RC Hedreen Company and developer of Olive 8 says he monitors market values but acknowledges the only price that matters is the one that a buyer wants to pay. “We’re not inclined to further discount given recent sales comps in the building,” he said. “We know Olive 8 provides a great value today and we’re working our way up the building. Our three year construction loan extension provides us the time to sell into an improving marketplace over the next two years or so. Fortunately, we’ve saved our best inventory.”

McAvoy reports 10 new sales have been accepted so far in 2011 and active negotiations are taking place on several other homes. “I think buyers and sellers are finding better balance in supply and demand at Olive 8 and elsewhere,” she said. “It’s a signal that the market is stabilizing and an increase in sales means buyers are becoming more confident in home values.”

###

About Realogics Sotheby’s International Realty: Representing a significant volume of new construction condominium closings in downtown Seattle since 2008, Realogics Brokerage, LLC (DBA Realogics Sotheby’s International Realty) has emerged as a leading

sales and marketing company in the Seattle area. Managed by Realogics, Inc., the collective presents a fully-integrated real estate solution comprised of market research, product developmen t, full-service marketing and sales. The Realogics Group of Companies owns a long-term franchise within the Sotheby’s International Realty network and has since established a fastgrowing resale division. Realogics Sotheby’s International Realty is independently owned and operated by Realogics, Inc. For more information, visit www.RealogicsSothebysRealty.com.