Seattle Floating Home Buying Guide (Updated for Winter 2024)

by Matt Goyer

Welcome to our 2023 Seattle floating home buying guide! Written by Matt Goyer a floating home agent and the owner and managing broker of the real estate brokerage Urban Living, this guide is based on his 9 years living on a floating home and his years helping many first-time floating home buyers. We wrote it to give you an overview of what it takes to buy a floating home in the Seattle area. It will also give you a good sense of what it is like to work with us. Do you still have questions? Reach us at hello@lake-life-seattle.com.

What is a floating home?

A floating home is a single-family dwelling constructed on a float that is moored, anchored, or otherwise secured in the water. Floating homes must be located in legally-established floating home moorages and must have direct connections to sewer and water utilities. There are 507 floating homes, and due to current legislation, no new floating homes will be added to Lake Union.

This guide covers floating homes but not houseboats (houseboats are otherwise known as a floating on water residences (FOWR) (there are 215 on Lake Union. See our Seattle houseboat guide for more details on them!), house barges (there are 27) or vessels with a dwelling unit (just 11!).

Floating homes range in size from 600 square feet (studios and one-bedrooms) to a little over 3,000 square feet (3-4 bedrooms). Many don’t have parking, but some in communities like Mallard Cove and Roanoke Reef, do have parking in nearby garages or surface lots.

In terms of floats (the “foundation” of a floating home), the most common float type is a log float, many of which are nearly a hundred years old. While newer homes sit on concrete floats, some of which even have underwater basements with underwater windows!

Floating home ownership structures

There are also two different types of floating home ownership structures:

Co-op: the land and docks are owned in common by the cooperative and members own a membership share which is a portion of the real property and grants them exclusive use of their slip. The floating homes are considered personal property.

Condominium: you own your floating home, the specific slip it sits in and have a common interest in the land and the dock.

Alternatively, some floating homes are in leased slips where someone else, either an individual or corpoation, owns the slip and you pay them rent.

How much does a floating home cost?

The price of a floating home ranges from about $500k up to about $6m. There are 507 floating homes on the lake spread across Eastlake, Westlake, Fremont, and Portage Bay. Roughly 3-4% of them sell every year, about the same percentage for on-land homes.

| Total # of sales | Off-market | Price range | $/Sq. ft. range | Days on market | |

|---|---|---|---|---|---|

| 2023 | 17 | 2 | $1.2m to $5m | $881 to $2,800 | 2 to 389 |

| 2022 | 22 | 6 | $600k to $6.25m | $670 to $3,970 | 1 to 302 |

| 2021 | 33 | 3 | $360k to $3.495m | $488 to $2,539 | 1 to 184 |

| 2020 | 27 | 5 | $530k to $4.35m | $650 to $2,447 | 1 to 356 |

| 2019 | 18 | $500k to $3.438m | $427 to $1,764 | 5 to 290 | |

| 2018 | 17 | $455k to $3.575m | $700 to $1,750 | 3 to 108 | |

| 2017 | 11 | $515k to $3.05m | $618 to $1,525 | 3 to 132 | |

| 2016 | 20 | $474k to $3.2m | $536 to $1,540 | 4 to 141 | |

| 2015 | 19 | $410k to $3m | $521 to $1,818 | 2 to 276 |

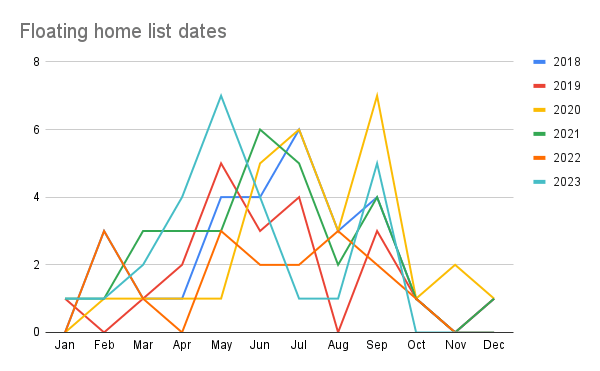

When is the best time to buy a floating home?

The “season” to buy a floating home, is not surprising, when the weather is nice. Here’s a look at when floating homes are typically listed for sale.

Why buy a floating home?

The lifestyle! What are the pros and cons? Read on…

What are the benefits of living on a floating home?

- Waterfront: live on the water minutes from downtown for much less than it costs to buy on the shores of Lake Washington.

- Swimming: for most homes, you can swim right off your deck!

- Tight-knit community: living in close quarters to your neighbors means you’ll get to know each other

- Boat moorage: moor a sailboat or motorboat right next to your house

- Wildlife: herons, beavers, otters, ducks, geese, fish, and more

- Events:

- Opening day

- 4th of July

- Christmas ships

- New years eve

What are the downsides to living on a floating home?

- Movement: depending on the size of your float and home, some homes can move quite a bit. Not good if you easily get motion sick.

- No parking: very few floating homes come with parking

- No garage: almost no floating homes have garages

- Limited storage: since most floating homes don’t have garages or basements, there is usually limited storage.

- Expensive: the cost per square foot is higher than a similarly sized land home

- Seaplane noise: depending on where you are on the lake, and how the wind is affecting take-offs and landings, you’ll hear the seaplanes

- Looky loos: kayakers, paddle boarders, and boaters will be looking in your windows curious about the floating home lifestyle

How does a floating home float?

Seattle floating homes are either constructed on a log float or a concrete float. Newer homes are usually built on concrete floats, while older floating homes or re-built floating homes float on a log float. Both float types are typically supplemented by containers of air (most commonly 55 gallon drums of air).

Do floating homes move a lot? Can you get seasick on a floating home?

Floating homes float so definitely expect that they’ll move! How much they’ll move depends on a number of factors – location, float construction, how it is connected to the dock, weather, boat traffic etc.

How does plumbing work on a floating home?

Floating home plumbing works nearly the same as a land home since floating homes are connected to both the city of Seattle’s water supply and the city of Seattle’s sewage system.

How does sewage disposal work on a floating home?

Floating homes are connected to the city of Seattle’s wastewater system. However, floating homes will have their wastewater go into a cistern which is then pumped up to the city’s wastewater system. The floating home’s cistern and pump system is typically more fragile, so floating homes owners and their guests need to take care to only flush toilet paper and nothing else down their toilets.

Where do floating homes get water from?

Floating homes are connected to the city of Seattle’s water supply just like a land home.

How do floating homes get electricity?

Floating homes are connected to the city of Seattle’s electrical grid just like a land home.

Do floating homes have natural gas?

Yes! Many floating home docks have a natural gas line that you can connect to.

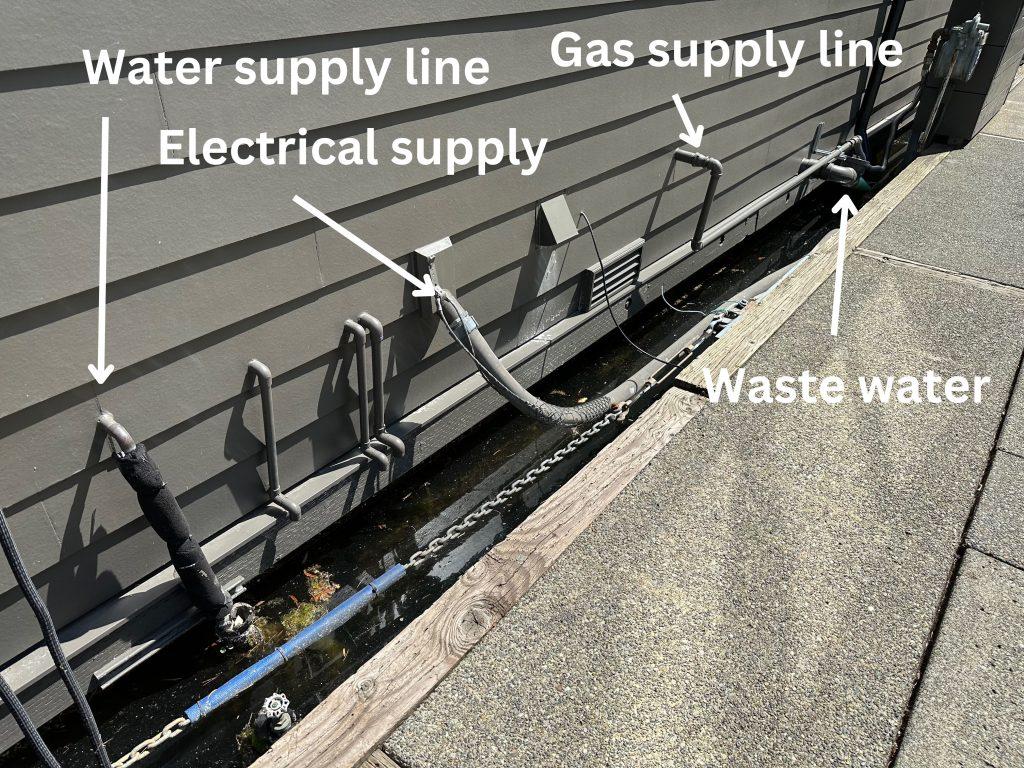

Example of utility connections on a floating home

Here’s how the various utilities connect to our floating home at Mallard Cove.

Are there floating home tours available?

If you’re curious about the floating home lifestyle but not yet at the point where you want to chat with a real estate agent, here are some ways to see floating homes:

- Our YouTube video tours!

- Charter tours

- Rent a boat

- Rent a kayak or paddle board

- Seattle Floating Home Association Tour: this tour occurs every two years. The next one will be in the fall of 2024.

Can I try before I buy?

Yes! There are a few floating homes available for month long rentals on the University Boat St dock:

- End of dock – 1 bed, 1 bath

- Middle of dock – 2 bed, 1.5 bath

- Middle of dock – 2 bed, 1.5 bath

How to get started buying a floating home

Most people start online. It’s easy to get sucked into browsing pretty pictures of homes, even before you’re seriously thinking about buying. But when it’s time to actually search for a home to call your own, online sites give you a way to see lots of homes in a short period of time and narrow down your search before you step foot in a single doorway. With so many places to look online, how do you know which ones are best?

Finding floating homes for sale

Lake Life Seattle will show you all the floating homes for sale. It is easy to browse them by neighborhood:

- Eastlake floating homes for sale

- Fremont floating homes for sale

- Northlake floating homes for sale

- Portage Bay floating homes for sale

- Westlake floating homes for sale

Here are a few other home search tips:

- Google Street View: Check out the area and see what the homes of your potential neighbors look like. Remarkably much of the lake has Google Street View coverage!

- Walk Score: See how many restaurants, bars, and shops are within walking distance of a home you’re considering.

What about off-market floating homes or word of mouth? In our own analysis, we found that approximately the same percentage of floating homes sell off-market as do regular homes. That said, we recommend working with an agent connected to the floating home community as they’re more likely than not to hear about off-market opportunities. So if you’re wondering what is quietly for sale, you can reach us at hello@lake-life-seattle.com.

How to pick a floating home real estate agent or realtor

When you want to start seeing homes in person, it is a good time to find an agent. Many home buyers end up working with the first agent they talk to, but we recommend being thoughtful and deliberate to find a floating home agent, like Matt, who specializes in floating homes. Floating homes are sufficiently different from a land home that you should work with an agent who is experienced in them.

Here are some questions to ask:

- Is this your full-time job? You want an agent who is doing real estate all the time and not just as a hobby or side gig.

- Do you live on a floating home? You want an agent who deeply understands the floating home lifestyle.

- How many floating home buyers or sellers have you helped? You want an agent who can guide you every step of the way.

- When am I committed to working with you? Some agents require you commit to working with them making it hard to “break” up if you decide that agent isn’t for you. At Urban Living, we don’t require you to sign anything. You’re free to work with another agent if you’d like.

- Who else will be working with me? Some agents are supported by teams. It is good to understand who else you might be working with throughout your transaction.

- Can I see reviews of your past deals? You want an agent who other people have loved working with. Zillow and Yelp are good places to look up agent reviews.

- What are a few examples of you going above and beyond for a client? You want an agent who will go the distance for you. If they’re good, they’ll have a few examples from past transactions.

- How will we work together? You want an agent who will be able to communicate with you in the way that you’re most comfortable. Here at Urban Living, we’re happy to collaborate over text message, Facebook, Whatsapp, Skype or Google Hangouts, if that’s what you prefer! Not all real estate agents are as tech-savvy.

- What sets you apart from other agents? Find out if this agent has something special to make them stand out.

How to pick a floating home lender

We recommend finding your floating home lender relatively early in your home search for three reasons:

Reason No. 1: It is important to know how much you can afford before you get too deep into your search. You don’t want to be falling in love with a place that you can’t afford!

Reason No. 2: If you have any issues with your ability to get a loan, it is better to find out sooner rather than later so you can resolve those issues and move forward.

Reason No. 3: If you’ve already secured a lender, we can move quickly when you want to make an offer.

Since there are only a few lenders who will lend on floating homes, picking a floating home lender will likely come down to talking to each lender and choosing the lender who has the right loan product for you at a competitive rate.

Here’s our list of Seattle floating home lenders.

What are the closing costs for a floating home?

Here’s what to expect in terms of costs when buying your home floating home:

- The home itself: prices in 2022 ranged from $670 to $4,000 a square foot, more than on-land homes!

- Inspections: budget $300-$600 for a home inspection plus $400-600 for a float inspection

- Closing costs:*

- Escrow fee: $2,110 to $2,410 for the buyer’s half depending on the price of the home

- Loan costs: .25% to 1% origination fee

*What about excise tax and title insurance? In Seattle, the seller pays those fees.

Here’s what to expect in terms of costs when owning your home:

- Taxes: 1.01% of the assessed value, which is typically less than market value (this explains is how the County taxes floating homes)

- HOAs: $200 to $1,000 a month depending on which dock you’re on and how they split costs

- Utilities: ask the seller for what they were paying

- Repairs: budget 1% of your purchase price a year, but hope for the best!

How do I see floating homes in person?

You can visit houses with your agent or by attending an open house.

When you’re getting started in your search, we recommend attending open houses to get a feel for what you like and don’t like.

But when you start to get serious, time is of the essence, particularly in a hot real estate market like Seattle. We recommend that your agent show you a home as soon as it comes on the market, so you can move quickly if you like the home. If you wait until the open house, you may be too late to put together a competitive offer and ultimately purchase the home.

When evaluating a home here are a few questions to ask yourself, beyond the basics about size and amenities:

- Can I see myself here for five to seven years? This is the average length of time that people live in a home before selling.

- Do I love the things about the home that I can’t change? For instance, you can’t change the location, but upgrading old appliances is easy.

- Does the neighborhood have the things I need? Which grocery store will you be visiting several times a week? Is there a dry cleaner nearby?

- What will my commute be like? Check it on Google Maps, or even better, get in the car, on the bus, or on your bike and experience it at rush hour.

- Which way does the home face? If you’re a morning person, consider what the morning light will be like. Evening person? Will you be able to see the sunset?

For floating homes, here are some specific questions to consider:

- Can I moor a boat? If so, what size? Not every floating home has moorage for a recreational vessel (power boat, sailboat, etc.). If this is important to you, be sure to inquire what the max length, width, and draft of the boat you can moor is.

- What is the parking situation? Most floating homes do not have designated parking spots and you’ll need to rely on street parking. Be sure to check out the parking situation fi you have a car.

- Is the dock well maintained? Some docks are very well maintained, others have been deferring maintenance for years and may need substantial work done. Replacing a dock, or even a few piers, is expensive!

- Can I swim off my home? You can swim off many homes, but for some homes close to shore you may not want to due to shallow water, seaweed, or milfoil.

- How is the storage space? Floating homes are notorious for having minimal storage space so be sure to check out what storage the home has available. If it doesn’t have enough, consider off-site storage facilities.

- What are the rules for remodeling? Not only do you have to follow city and state building codes, but almost all docks will have their own rules about remodeling or replacing your floating home. Be sure to review those rules ahead of time as they may limit what you were thinking you could do. (I.e. some docks have height restrictions lower than the city’s restriction.)

Researching floating homes homes

Here are some helpful links so you can dig in and learn more about a home:

- Permit search: helpful to check if they actually permitted the work they did

- King County Parcel Viewer: authoritative source for property history, though for co-op docks you won’t be able to see individual slips.

- Flight patterns

- Noise complaints

- WSDOT noise policy

- Trulia’s crime heatmap

- Seattle Police Department’s crime maps

- Earthquake fault lines [pdf]

- Seattle Department of Construction & Inspections GIS

Writing an offer on a floating home

Writing an offer on a floating home home with an offer deadline

In 2024 great floating homes will still sell quickly and may have an offer deadline so we should expect that there may be several offers. In these situations, you need to make sure YOUR offer stands out. To do that we need to make your offer competitive, and we do so by showing you are serious which means limiting your ability to back out of the deal. If you’re at all hesitant about buying the home, we recommend not offering on it!

Here’s how to make your offer competitive:

Understand the seller: Have your agent find out everything you can about the seller and the situation. Does the seller want to close quickly so they can move on to their next home? Or would a longer closing be more appealing so they can stay in the house a little bit longer and find their next home? Any information you have about the seller and their motivations will help you write the best offer.

Get the home pre-inspected: Typically, a home purchase offer would be contingent upon an inspection of the home by a licensed inspector. But when a home has an offer deadline, we recommend inspecting the home BEFORE making an offer so that you can waive your right to inspect. This is known as a pre-inspection. This is another reason you want to see homes as soon as they hit the market because we’ll only have a few days to get an inspector into the house before making an offer. Now, unlike homes that aren’t competitive, you likely won’t be able to request repairs from the seller. Instead, you’ll have the benefit of understanding the condition of the home before writing your offer.

Strong price: It’s not always the case, but the highest price often wins. While the listing price gives us a starting point, we’ll determine what we think the home is worth in the current market based on recent comparable sales. We’ll also gauge how much competition you may be up against by calling the listing agent and asking how many offers they’re anticipating.

Escalation clause (Escalator clause): In a competitive situation, we can consider adding an escalation clause to your offer. What this does is automatically increase your offer price if someone offers more than you. You’ll specify what your initial offer price is, your maximum offer price, and your bid increment. For example: If you offer $500,000 on a home and agree to increase the offer by $5,000 up to a maximum price of $580,000.

Pay cash: Of course, cash is king. A cash buyer will close faster than someone who has to finance a home purchase, and there is much less risk that the deal won’t close. Even if you’re pre-approved, there is always the possibility that your financing will fall through. Just under a quarter of homes in the Seattle area are purchased with cash.

More earnest money: Earnest money demonstrates that you are serious about buying the home. This is usually 3% of the purchase price that you pay upfront. You can increase the strength of your offer by putting down more earnest money or, if you’re REALLY serious, making a portion of that earnest money immediately nonrefundable.

Review the HOA docs ahead of time: Some listing agents make the dock’s homeowners association docs available for review ahead of time. If they do, we should review them and waive making our offer contingent upon their review.

Strike clause “x”: The purchase and sale paperwork includes a “Information Verification Period”. In multiple offer situations we strongly recommend striking this.

Write a letter: it never hurts to write a letter to the seller expressing why you think you’ll be a great fit for their home.

There are a few other tactics we at Urban Living can use to help you buy your dream home, but we don’t want to give away all our secrets!

Writing an offer on a floating home home that has been on the market longer than a week or two

If a home has been for sale a little longer, or doesn’t have an offer deadline, we’ll take a different approach. We generally won’t waive contingencies, can put down less earnest money, and have more bargaining power in our offer.

Inspection: In almost all cases, we recommend that you make your offer contingent upon hiring a licensed inspector to inspect the home you’re interested in. The cost is around $300-$500. We also recommend you have the float inspected by a dive company. The cost is around $400-600. If you’re financing your purchase, your floating home lender will require a dive inspection.

Price: While the listing price gives us a starting point for what to offer, what we’ll do is figure out what we think the home is worth based on looking at recent comparable sales. In an instance where the home has been on the market for a while, we may find that the market is not warranting the list price, and may offer less.

Floating home inspections

We highly recommend getting an inspection*! Whether you do this before or after you make your offer, it is $300-$500 well spent to know the full condition of your house.

We can recommend a few floating home inspectors we’ve worked with in the past. The cost and length of the inspection depends on the size and age of the house but it usually takes a few hours and, as we said above, costs between $300 and $500. We encourage you to attend the inspection with us and the inspector but the inspector will send us a report with pictures after they are done. Together, we’ll determine which issues we want to raise with the seller if our offer is contingent upon an inspection.

As mentioned elsewhere, you should also have the float inspected. The cost is around $400-600. Here’s the inspection report I received on the floating home I purchased as well as a video of the float:

Closing a floating home deal

When a seller has accepted your offer, you are now in mutual acceptance, but we’re not done yet! There are still a few more weeks of due diligence and paperwork before you can move in.

Another way that floating home sales differ from traditional sales, is that there is really only one company that handles escrow for floating homes and that’s the Assemble Law Group.

Right away

Earnest money: The first order of business is to get the earnest money to the escrow attorney. Typically the company will dispatch a courier to pick up a personal check, or you can wire the money. This needs to happen within two business days of mutual acceptance.

Within five days

Loan application: If you’re financing, you’ll need to kick off the mortgage process with your lender by forwarding them the signed purchase and sale contract. Typically you have five days from mutual acceptance to apply for your loan. If you need to change lenders, keep in mind that we’ll need to notify the sellers. If you’re still shopping lenders, you’ll want to get a loan estimate from each and compare them to determine who you want to go with.

Inspection contingency: If your offer is contingent on a home inspection, we’ll want to get it scheduled and conducted as quickly as possible so we have time to negotiate, if necessary, with the seller on any repairs or credits. Typically you have 10 calendar days to do this.

Resale certificate reviews / Homeowner association review: if your offer is contingent upon reviewing the resale certificate or homeowner association docs, we will want to get a copy from the seller who gets it from the dock’s management company. This lengthy document lets us know the health of the dock’s homeowner association. You’ll want to be sure to give it a close read.

Almost done

Utilities: You’ll want to call your new utility providers to set up accounts.

Insurance: You’ll want to contact an insurance provider about home insurance. Unlike a traditional home, there are only two insurance companies who handle floating homes. They are Lloyd’s of London and Red Shield Insurance.

Final walkthrough: If you inspected the home and requested repairs, we will schedule a time to review the repairs several days prior to closing.

Closing appointment: Several days before the close date, escrow will have you sign the closing documents. If you are financing your purchase, this needs to be an in-person signing. If you’re paying cash you can do it remotely and scan in the documents. Around this time you’ll also need to make arrangements for wiring the money you need to close the deal.

Key exchange: On the day of closing we’ll meet with you to exchange keys.

Moving: Once you have the keys to your new home, you can move in! We highly recommend a mover who can both pack and move you. It makes life so much less stressful.

Remodeling a Floating Home

For remodeling that involves exterior work, or working over the water, we recommend going with a contractor who has past experience with that type of work:

How much does it cost to remodel a floating home?

The cost of remodeling a floating home is a little more expensive than remodeling a regular home on land. We say it is a little more expensive due to the additional labor involved in dealing with limited parking, distance to the house from parking, difficulty in storing materials, etc.

Building a New Floating Home

Thinking of building a new floating home? Here’s the handful of builders who specialize in building floating homes from scratch:

- Brightworks

- DBoone Construction

- Dyna

- Envirotecture

- G Little Construction

How much does it cost to build a floating home?

We just built a floating home, so we can, unfortunately, confidently tell you the cost is in the $800-1,000 a square foot range with it taking 3 years start-to-finish if you and your architect and builder move quickly. For our build, the cost is $900 a square foot and it will have taken just under three years from when we bought our “tear down” to when we move in.

YOU MIGHT ALSO LIKE