Mortgage rates drop as jobless claims hit pandemic-era low

National mortgage rate averages dipped slightly for the second week in a row. This news comes on the heels of great jobless claims and continued vaccine roll out. Jobless claims fell from 769k to 576k, a pandemic-era low. Nearly every state will have universal eligibility for vaccines by April 19th.

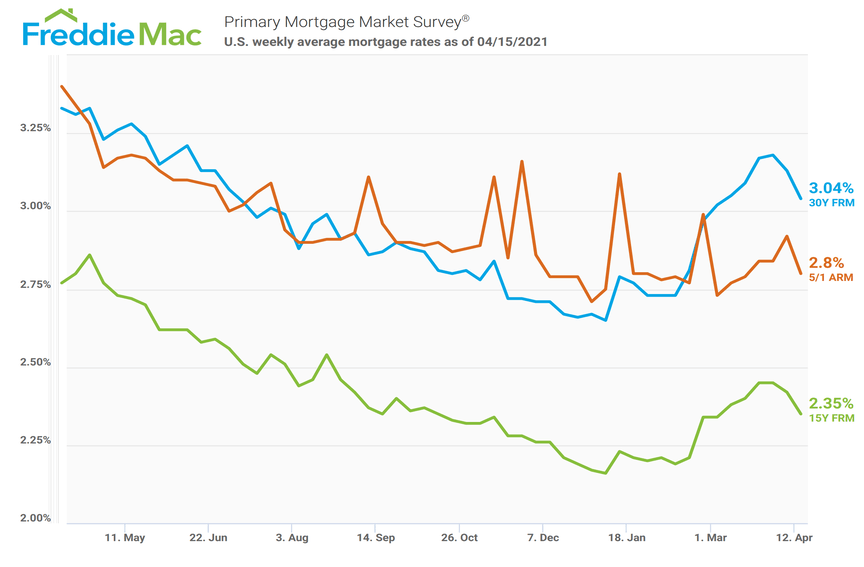

Mortgage rates dipped to an average 3.04% with 0.7 points (here’s a good breakdown of what points are) on a 30-year fixed-rate mortgage. This is down just .09% on last week’s average. The 15-year fixed-rate mortgage averaged 2.35% with 0.6 points, down .07% week-over-week. Both are still down .27% and .45%, respectively, from this time last year.

It will be interesting to see if lower rates this week will have driven more buyers back into the market after spring breaks have wrapped up. However, competition for homes is still fierce with prices at all-time highs due to lack of new construction and the impact of sky-high lumber prices on builders being able to start projects. Some buyers may continue to be patient despite the lowest rates we’ve seen in several weeks.